IR35: six months on

It’s been six months since the IR35 rules were extended, in what was arguably one of the biggest legislative changes to affect the production industry in the past decade.

Many production companies must now assess the employment status of anyone they engage through a loan-out to determine whether they’re employed or self-employed for tax purposes before they begin work.

With the grace period for genuine errors set to expire in April, here’s a quick refresher on who the IR35 rules apply to, as well as a handy checklist for assessing your current processes. (For an in-depth look at IR35, check out POP’s guide to IR35 for production.)

What changed?

Following the rule changes, medium and large companies that engage contractors through intermediaries are now responsible for applying the IR35 rules. If an assessment deems the contractor employed for tax purposes, they can still be engaged through an intermediary. However, the fee payer (usually the production company, unless an agent is involved) is responsible for making deductions for income tax and national insurance contributions (NICs) and paying these to HMRC (although due care should be given to the accounting and contractual complexities of this approach).

Who does IR35 apply to?

The IR35 changes only affect large and medium businesses in the private sector. A company (or group of companies where relevant) will be deemed a large or medium business for these purposes if two or more of the following criteria are met:

-

The company (or its parent) has an annual turnover of more than £10.2m.

-

The company’s (or its parent’s) balance sheet is more than £5.1m.

-

The company (or its parent) has more than 50 employees.

Note that if your production company is part of a group, the test applies to your parent. That means that even if you’re a small production company subsidiary, the IR35 rules may apply.

If you set up and use special purpose vehicles (SPVs) to run single productions, the IR35 rules apply if the SPV’s parent is a medium or large business.

Who’s exempt?

Broadly speaking, the IR35 rules may not apply to:

-

Small companies (which don’t meet the above criteria).

-

New companies (other than subsidiaries).

-

Engagements where you’re using an employment agency or umbrella company that organises PAYE and NICs for your contractors.

However, the rules are complex, so do seek professional advice. HMRC provides some useful guidance on umbrella companies here.

Note that for new companies (which aren’t subsidiaries of large and medium companies) and small companies which are on the cusp of qualifying as medium, special “transitional” rules apply.

Your IR35 checklist

It’s important to have processes in place to ensure you comply with the IR35 rules as not doing so may be seen as an act of negligence by HMRC (and result in fines).

This handy checklist can help you to determine whether you have a solid IR35 process in place.

-

Have you introduced a process for hiring contractors so you can identify crew who need IR35 assessment?

-

Have you introduced an assessment process?

-

Have you introduced a process for creating, distributing and storing status determination statements (SDS)?

-

Have you developed an IR35 dispute resolution procedure that aligns with your statutory obligations?

-

Have you provided adequate training to your production office teams on how to complete assessments, create and send SDS and securely store all of your communications? Consider whether any new staff require training or whether refresher training is needed for existing staff.

-

Have you let all of your contractors know about the new IR35 rules and how you handle them?

-

Have you introduced a system for maintaining oversight of the IR35 processes on your shows and do you have mechanisms in place to course correct if necessary?

Remember that IR35 is not a one and done process - you need to reassess on a regular basis and have auditable systems in place to evidence that reasonable care has been taken.

How can POP help?

POP’s Production Portal is the workforce platform for smarter production. It streamlines and connects your operations and simplifies compliance, all while giving you full visibility across your shows.

Although the Production Portal isn’t a tax assessment tool, it includes functionality to help simplify compliance and create a secure, audit ready trail to assist your IR35 process.

-

Deal warning flags help your production teams to consider compliance from day one. The flags alert your production teams to potential IR35 risk during the deal creation process, helping them to get set up without time-wasting error corrections and amendments.

-

A digitised Pact standard SDS allows you to create, send, store and track your entire SDS process in one place. If a dispute does happen, all of your communications are securely stored in one place ready to be provided to HMRC.

-

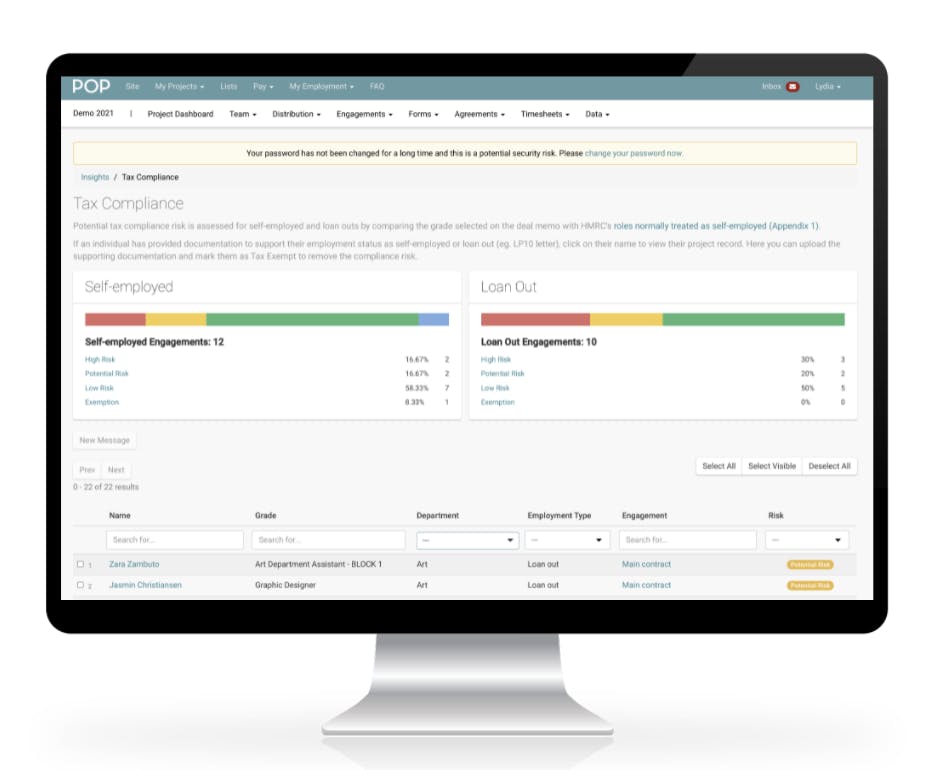

A tax compliance report provides an instant view of what’s happening on your shows, so you can see how much risk your productions are carrying and course correct if needed (without chasing your production office team or trawling through files and spreadsheets).

Productions don’t have to be a scramble. POP gets you up and running quickly and compliantly, so you can put your energy into the show.

To see more of what our tech can do, contact hello@wegotpop.com.